Introduction

The Forex market, also known as the foreign exchange market, is a global marketplace where currencies are bought and sold. It is the largest and most liquid financial market in the world, offering an abundance of opportunities for traders worldwide. At the core of forex trading lies the concept of currency pairs, a fundamental element that forms the basis for all transactions. In this blog post, we embark on an exploration of the intricate world of currency pairs traded in the Forex market, understanding their types, characteristics, and significance.

ISO Currency Codes

In 1973, the International Organization for Standardization (ISO) introduced ISO 4217 Currency Codes, which are three-letter codes assigned to country currencies. Comprising three characters, the first two denote the country, while the third signifies the currency’s name. For instance, the United States dollar code utilizes the initial two letters of the country (US) and the third letter (D) for “dollar”. These codes offer a standardized means of representing currencies across diverse contexts, encompassing financial transactions, banking, and international trade.

Here is a glimpse of some country currencies:

Pair Trading System in Forex

In the Forex market, currencies are traded in pairs, with the base currency appearing first and the quote currency to the right, reflecting the exchange rate between the two. For instance, GBP/USD signifies the value of the British pound in relation to the U.S. dollar. While there are numerous possible combinations, some widely traded pairs include-

➣ the euro against the US dollar (EUR/USD),

➣ the US dollar against the Japanese yen (USD/JPY),

➣ the British pound against the US dollar (GBP/USD),

➣ the Australian dollar against the US dollar (AUD/USD)

Exchange rates fluctuate based on which currency is stronger, and the value of a currency in relation to other currencies reflects the state of that nation’s economy.

Types of Currency Pairs

Major Currency Pairs

The most liquid major currency pairs globally include EUR/USD, USD/JPY, GBP/USD, AUD/USD, USD/CAD, and NZD/USD. These pairs often serve as indicators of market sentiment and economic health.

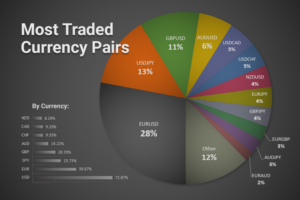

EURUSD or Fibre: The EURUSD currency pair holds the distinction of being the most actively traded in the global forex market, constituting 28% of the overall multi-billion dollar turnover. The dynamics of this pair are primarily influenced by the United States and the European Union. According to Kočenda and Moravcová (2018, p. 597), their analysis underscores that the EURUSD exchange rate stands as the most extensively traded globally. Notably, fluctuations in this exchange rate have a direct impact on the pricing of exchange rates denominated in EUR and USD, effectively eliminating arbitrage opportunities in the markets.

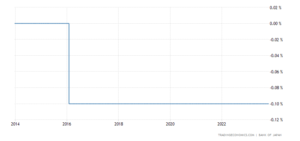

USDJPY or Ninja: USDJPY is a currency pair where the value of a single pip is much larger than that of other currencies due to the relatively low value of the yen against the dollar. This is due to the Bank of Japan’s quantitative easing and low interest rate policies, which have resulted in near-zero or even negative interest rates in Japan.

Image shows interest rates in Japan for the last 12 years, which have reduced from 0.1% in FY 2010 to – 0.1% in FY 2023. (Image Source: TradingEconomics)

USDCHF or Swisse: The Swiss Franc is seen as a safe haven due to its stable political and financial position and has a negative correlation with the EURUSD and GBPUSD currency pairs due to its positive correlation with the Euro, Swiss franc, and British pound.

GBPUSD or Cable: GBPUSD is the world’s third-most widely traded currency pair, accounting for 11% of global forex turnover. It has a negative correlation with USDCHF and a positive correlation with EURUSD, and monetary policy can lead to violent moves in the exchange rate.

AUDUSD or Aussie: Commodities and metals market valuations of coal, iron ore, and copper directly impact AUDUSD, while the Reserve Bank of Australia (RBA) and Australia’s exports to China play significant roles in influencing it.

USDCAD or Loonie: Because oil is Canada’s main export, the value of the Canadian dollar, USDCAD, is closely correlated with oil prices. OPEC’s (Organisation of the Petroleum Exporting Countries) production quotas could affect the Canadian dollar if the price of oil changes.

NZDUSD or Kiwi: The Reserve Bank of New Zealand’s interest rates diverge from those of the US Federal Reserve, which can have a significant impact on the NZDUSD exchange rate.

Image shows the most traded currency pairs in Forex in 2023.

Cross Currency Pairs

Cross-currency pairs are pairs that do not include the US Dollar, such as GBPJPY, EURGBP, EURJPY, and EURCHF. They can be used as an arbitrage opportunity and hedge against foreign exchange rate changes due to the surge in demand for foreign currencies and the expansion of the foreign exchange market.

Exotic Currency Pairs

Exotic currency pairs are major currency pairs with emerging countries’ currencies, such as Brazil, Mexico, Chile, Turkey, or Hungary. They are not heavily traded, leading to higher transaction costs and higher exchange rate spreads. They are also more sensitive to economic and geopolitical events due to lower liquidity. documented the fact that scheduled US macroeconomic news and central bank announcements increase the likelihood of return and liquidity of emerging market currencies.

What are the Base and Quote currencies?

Understanding base and quote currencies is fundamental in Forex trading. The base currency is always on the left of a currency pair, and the quote is always on the right. The base currency is always equal to one, and the quote currency is equal to the current quote price of the pair – which shows how many of the quote currency it’ll cost to buy one of the base. In other words, currency pairs compare the value of one currency to another, it indicates how much of the quote currency is needed to purchase one unit of the base currency.

To illustrate, consider the currency pair “GBP/USD”, where GBP is the base currency and USD is the quote currency.

If the GBP/USD pair is trading at 1.21228, it signifies that one British Pound (GBP) is worth 1.21228 U.S. dollars (USD).

Buying and Selling of Currency Pairs – How does it work?

Traders predict currency pair movements to profit from one currency strengthening or weakening against another. Buying a pair indicates an expectation of the base currency strengthening against the quote while selling suggests an anticipation of the base currency weakening against the quote.

In the case of the EUR/USD pair, you would ‘go long’ if you anticipated the euro strengthening against the dollar. This implies that more dollars would be required to purchase a single euro. Conversely, you would ‘go short’ on this pair if you believe the euro will weaken against the dollar, indicating that fewer dollars would be needed to buy a single euro.

Factors Driving Currency Pair Movements in Forex Trading

The movements of currency pairs in the forex market are influenced by a multitude of factors.

➣ Economic indicators such as GDP growth, employment figures, and inflation rates wield considerable influence over currency values.

➣ In addition, the decisions made by central banks regarding interest rates can either attract or discourage foreign capital, thereby affecting currency pairs.

➣ The element of political stability is also paramount, as political events have the potential to impact a country’s economic performance and, subsequently, its currency.

➣ Market sentiment, which reflects the perceptions and emotions of traders, plays a pivotal role in driving trends or reversals in currency pairs. Traders’ reactions to various events can significantly impact market dynamics.

Central banks are central players in the realm of currency combinations, exerting direct influence over their respective currencies through monetary policy. Their determinations regarding interest rates, money supply, and foreign exchange interventions have a direct bearing on a currency’s strength or weakness in the international market. Disregarding the impact of central banks can lead to inaccurate assessments and expose individuals to financial risks.

The Importance of Mentorship in Forex Trading

In forex trading, currency pairs fulfill various roles, such as facilitating diversification to distribute risk across different markets, capitalizing on the volatility and liquidity inherent in major pairs, and enabling the implementation of effective risk management strategies through an understanding of the correlation between various currency pairs.

To comprehend these concepts thoroughly, it is advisable to seek mentorship with experienced and knowledgeable forex traders or financial experts who have a proven track record of successfully navigating the complexities of currency trading.

Explore a variety of educational programs, including webinars and seminars, provided by Tradeshala. These programs are tailored to assist you in recognizing potential trading opportunities across various financial markets, including forex. Discover more by clicking here.

Some of the most popular forex trading styles include scalping, day trading, swing trading, and position trading. The choice of a specific trading style often depends on whether one has a short-term or long-term outlook. Engaging in mentorship with Tradeshala can provide valuable insights and guidance on how to navigate these trading styles and concepts effectively.

Learn How to Trade Forex with Tradeshala

In the ever-evolving world of forex trading, currency pairs are key players, offering a spectrum of opportunities for traders. Whether your focus is on major, minor, or exotic pairs, a comprehensive understanding of their characteristics and the factors driving their movements is crucial for success. Forex, being the most-traded financial market globally, presents constant price movements, creating abundant trading opportunities.

To thrive in forex trading, it is essential to leverage educational resources and platforms that can enhance your confidence. Tradeshala offers a plethora of valuable information to acquaint you with the markets and equip you with the necessary skills to increase your likelihood of achieving success in forex trading.

Explore training and internship opportunities to sharpen your trading skills and become a valuable asset in the financial world – Apply Here

Click here to join Tradeshala community for the latest market updates.

Written By-

Mini Agarwal

Specialist Tutor & Research Analyst