Introduction

If you are interested in the world of Forex, you have probably encountered the term ‘pip’ or ‘pips’—a fundamental and essential concept in Forex trading. Pips serve as the fundamental and crucial unit of measurement while trading Forex.

Understanding what PIP is and how to calculate its value in dollars is crucial for anyone venturing into the dynamic world of foreign exchange. Understanding the value of a pip is crucial for assessing potential gains or losses in trading. Before making currency trades, traders need to figure out how much money they might gain or lose by calculating the number of pips expected in the currency’s movement.

In this blog post, we’ll break down the meaning of PIP and guide you through the process of calculating its value in dollars.

What is PIP?

Forex traders engage in the buying and selling of a particular currency, with its value denoted in relation to another currency. The prices you see for these currency pairs are shown as bid and ask spreads, usually with four decimal places.

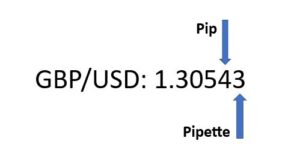

In Forex trading, The term “pip” is an acronym for “percentage in point” or “price interest point.” it represents the smallest whole unit of movement in a currency pair’s exchange rate. it is a standard unit for measuring how much an exchange rate has changed in value.

Example:

If the EUR/USD rate moves from 1.14988 to 1.14998, that 0.0001 rise in the exchange rate is ONE pip.

This applies to all currency pairs which are quoted to a standard four decimal places, but there are exceptions like Japanese Yen pairs. which are quoted to just two decimal places. In currency pairs involving JPY, a single pip corresponds to the second decimal place. If USD/JPY moves from 142.07 to 142.08, this means a one pip move. In the case of the Japanese Yen, a pip would be 0.01.

Pips, which are used in forex trading, should not be confused with bps (basis points) used in interest rates markets that represent 1/100th of 1% (i.e., 0.01%).

What is a Pipette?

In the past few years, as trading technology has progressed, numerous brokers now provide pricing with an additional decimal place. This typically involves extending to a fifth decimal place for the majority of currency pairs (except JPY pairs which have three decimal places). This fifth decimal place is what is referred to as a “fractional pip” or “pipette.” In other words, “pipette,” refers to the movement at the fifth decimal place, representing a fraction of a pip, precisely one-tenth of a pip.

1 Pip = 10 Pipettes

Example:

If the EURUSD price moves from 1.14988 to 1.14998, this is one pip movement. If the price moves from 1.14982 to 1.14987, then it has moved by 5 pipettes. Traders often use pips to indicate their profits and losses in Forex trading.

What are Lots in Forex and How do you Calculate Lot Sizes?

Before delving into pip value calculation, let’s first grasp the concept of lot sizes, as they play a crucial role in determining the monetary value per pip. In forex trading, the term “lot size” refers to the volume or quantity of a trade. It’s the amount of base currency (in units) you’re buying or selling. With this measure, traders with different amounts of money can make trades that match the size of their trading accounts.. It is a standardized unit of trading that helps investors and traders manage their positions. Lot sizes are used to control the size of a position and, consequently, the amount of risk taken on a trade.

In forex trading, there are three main sizes for lots:

Standard Lot:

A standard lot represents 100,000 units of the base currency in a currency pair.

For example, in the EUR/USD pair, a standard lot is equivalent to 100,000 euros.

Mini Lot:

A mini lot is 1/10th the size of a standard lot, representing 10,000 units of the base currency.

Using the EUR/USD example, a mini lot would be 10,000 euros.

Micro Lot:

A micro lot is 1/100th the size of a standard lot, representing 1,000 units of the base currency.

Using the EUR/USD example, a micro lot would be 1,000 euros.

Nano Lot:

A nano lot is 1/1000th the size of a standard lot, representing 100 units of the base currency.

Using the EUR/USD example, a nano lot would be 100 euros.

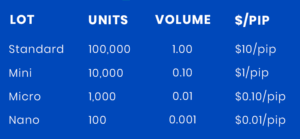

The choice of lot size is important because it determines the monetary value of each pip movement in the currency pair. The value of a pip varies depending on the lot size.

How to calculate PIP Value in Dollars?

The value of a PIP is crucial in determining the potential profit or loss in a trade. The PIP value is influenced by three main factors: the size of the trade, also called lot sizes, the currency pair being traded, and the exchange rate.

Pip Value Calculation when Trading in a USD Account

For Pairs with the U.S. Dollar as the Base Currency

The most heavily traded currency pairs in the world involve the U.S. dollar (USD). Major currency pairs such as USDJPY, USDCHF, USDCAD all have the U.S. dollar as the base currency. The same pip values apply to all currency pairs with the U.S. dollar traded as the base currency in an account denominated in U.S. dollars.

For these direct quotes, that is, where the US dollar is in first place in the pair, the value of a pip will be calculated by the formula:

Pip Value = Lot Size * Pip Size / Current Exchange Rate

Example:

Let’s say you have opened a buy trade with volume of one mini lot 0.1 (10,000 units) of USDCHF currency pair with a currenct exchange rate of 0.85304. If the currency pair moves by 1 PIP, the PIP value can be calculated as follows:

1 PIP = 10,000 x 0.0001 / 0.85304 = $1.17 or $1 round figure.

If the price of a USDCHF currency increases by 50 pips, then the trader will earn $58.61 ($1.17 x 50), and if the trade is closed by a stop loss set at a distance of 30 pips, then his loss will be $35.16 (($1.17 x 30).

For Pairs with the U.S. Dollar as the Counter Currency

Major currency pairs such as EUR/USD, GBP/USD, AUD/USD and NZD/USD all have the U.S. dollar as the counter currency.

In case of a reverse quote (the dollar is in second place) or cross rates (where the dollar is absent). There is a little different with the calculation of the value of a pip , the value of a pip will be calculated by the formula:

Lot Size * Pip Size

Example:

Let’s say you have opened a buy trade with volume of one mini lot 0.1 (10,000 units) of EURUSD currency pair with a currenct exchange rate of 1.10268. If the currency pair moves by 1 PIP, the PIP value can be calculated as follows:

1 PIP = 10,000 x 0.0001 = $1

For reverse quotes, 1 pip with a transaction volume of 0.1 lot will always equal 1 dollar, regardless of the current exchange rate

If the price of a EURUSD currency increases by 50 pips, then the trader will earn $50, and if the trade is closed by a stop loss set at a distance of 30 pips, then his loss will be $30.

In other words, When USD is listed second in a pair, pip values are fixed and don’t change if you have an account funded with U.S. dollars.

The fixed pip amounts are:

➣ $10 for a standard lot (100,000 units of currency)

➣ $1 for a mini lot (10,000 units of currency)

➣ $0.10 for a micro lot (1,000 units of currency)

➣ $0.01 for a nano lot (100 units of currency)

These pip values are the same for all currency pairs where the U.S. dollar is the currency being traded in an account denominated in U.S. dollars.

Pip Value for Cross Currency Pairs

If your account currency is USD, it doesn’t mean you can only trade USD pairs. You might want to trade pairs like EUR/GBP or GBP/CAD, where your account currency is not directly involved. In such cases, the value of the second currency in the pair is constant, especially if your account is in that currency. To determine the pip value for these pairs, you’ll need to consider this fixed relationship.

Let’s say you have a GBP account, and you’re trading the EUR/GBP. For a mini lot, each pip is worth GBP1. Now, to find out how much that is in your own currency, let’s say USD, you divide GBP1 by the USD/GBP exchange rate. For example, if the rate is 0.78764, then each pip is equivalent to USD$1.27.

Pip Value Calculation for a Non-USD Account

If the second currency in a pair is the same as the currency in which the account is funded, the pip values remain constant.

Example:

If your account is in Canadian dollars (CAD) and CAD is the second currency in a pair (e.g., USD/CAD), the pip values are fixed:

➣ CAD$10 for a standard lot (100,000 units of currency)

➣ CAD$1 for a mini lot (10,000 units)

➣ CAD$0.10 for a micro lot (1,000 units)

➣ CAD$0.01 for a nano lot (100 units).

If CAD is listed first, find the pip value by dividing the fixed rate by the exchange rate. For instance, if the CAD/CHF exchange rate is 0.64375, a pip is worth CAD$1.55 for a mini lot (CAD$1 divided by 0.64375).

For a euro account and wanting to know the pip value of the AUD/CAD, considering a CAD account has a fixed CAD$1 pip value for a mini lot, convert this value to euros by dividing it by the EUR/CAD rate. If the rate is 1.46260, the standard lot pip value is EUR 0.683.

JPY Exception

Japanese yen pairs are an exception to the usual four decimal places rule, as they use 2 decimal places instead of the usual 4 decimal places. So, a single whole unit pip is 0.01 rather than the 0.0001 for other currency pairs.

Example:

For currency pairs such as the EUR/JPY and USD/JPY, the value of a pip are calculated as –

If Exchange rate of EURJPY(cross currency pair) is 156.56, then one pip value for mini lot would be

1 PIP = 10,000 x 0.01 = ¥100

If you have USD account then, converting JPY into USD by dividing 100 JPY with exchange rate of USDJPY 141.95 resulting in $0.704.

If Exchange rate of USDJPY (USD is in base currency) is 141.95, then one pip value for mini lot would be

Pip Value = Lot Size * Pip Size / Current Exchange Rate

1 PIP = 10,000 x 0.01 / 141.95 = $0.704.

How to Measure Pips on the Currency Chart

To measure pips on a currency chart, follow these simple steps:

➣ Identify the price move on the chart.

➣ Mark the starting point of the move.

➣ Mark the ending point of the move.

➣ Subtract the starting price from the ending price.

Example:

In the EUR/USD chart, if the price drops from 1.1160 to 1.1045, the calculation is: 1.1045 – 1.1160 = -0.0115. This means the price has decreased by 0.0115, or 115 pips in the case of EUR/USD.

The Role of a Pips Calculator

In Forex, 1 pip always represents a certain amount of money. When calculating potential profit or loss, traders convert these pips into dollars. You can do this manually or use automated tools.

A Pips Calculator is a helpful tool in Forex trading because it helps you figure out the monetary value of a single pip in your chosen currency. This calculation is crucial for assessing potential profits or losses in a trade. Using this tool, you can quickly determine whether a trade is worthwhile in terms of time, money, and risk. It also aids in effective risk management.

To calculate the pip value, the calculator multiplies the trade amount in lots by the value of one pip and then divides the result by the current exchange rate of the quoted currency. All you need to know are

➣ the position size,

➣ the currency pair you’re trading,

➣ the exchange rate, and

➣ the base currency.

This simple process helps traders make informed decisions about their trades.

Tradeshala Internship recognizes the importance of providing accessible tools for learning. While many brokers offer Pip Calculators on their platforms, aspiring traders can explore resources like the one from the XM broker, a popular choice known for its user-friendly interface. Explore the XM Pip Calculator here.

Learn by Doing: Apply Knowledge in Real Markets

Tradeshala aims to support investors and learners by offering assistance on topics such as Forex and Crypto markets, commodities like gold, silver, platinum, crude oil, and investment planning.

Tradeshala internship and Tradeshala Academy of Training plays a crucial role in empowering the younger generation and aspiring traders in developing their trading skills. We offer valuable insights, hands-on experience, and expert guidance, creating a structured learning environment for aspiring traders. Here’s how these programs can be beneficial:

✔ Practical Application of Knowledge:

✔ Mentorship and Guidance

✔ Risk Management Skills

✔ Building a Trading Strategy

✔ Networking Opportunities

✔ Understanding Market Psychology

Embark on your journey into the world of trading! Enroll now and unlock the potential for financial success.

If you are interested in an internship program, Apply Here

If you are interested in the Tradeshala Academy of Trading, Apply Here

Click here to join Tradeshala community for the latest market updates.

Written By-

Mini Agarwal

Specialist Tutor & Research Analyst