Financial leverage is an important concept to understand when trading in the financial markets. It is a tool used to amplify returns and magnify losses. Calculating leverage can be a complex task, and it’s essential to know how it works in order to assess risk and take advantage of opportunities. In this blog post, we’ll discuss the pros and cons of financial leverage and answer the question: is financial leverage an opportunity or a risk?

What is financial leverage?

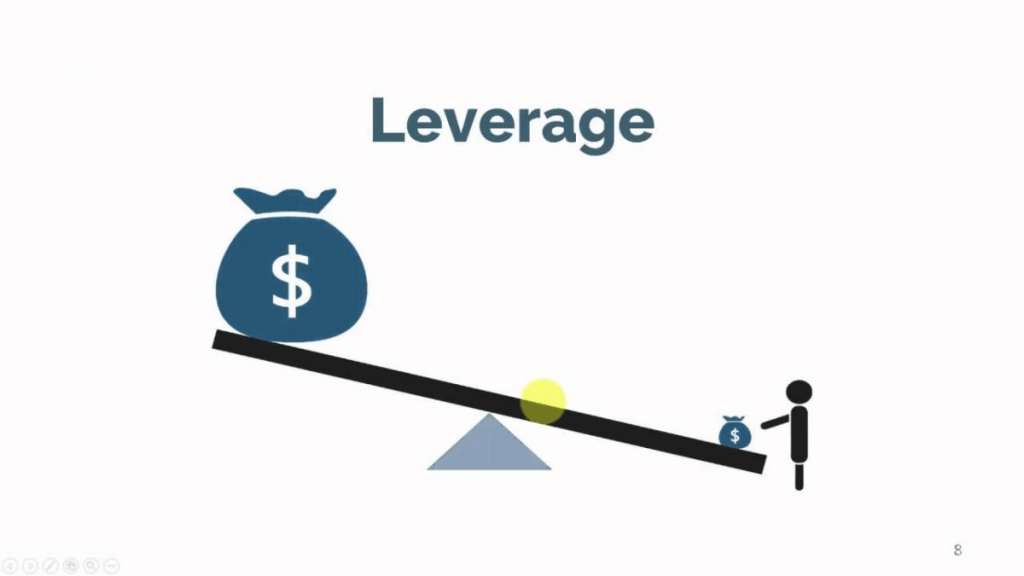

Financial leverage is the use of borrowed funds to increase the potential return on an investment. It involves taking on debt in order to increase equity returns, or borrowing money to invest in more assets. Leverage can also refer to a company’s use of debt, such as issuing bonds or loans.

By taking on debt, companies can borrow money to purchase more assets or to expand operations. This can increase profits and overall return on investment if the investments are successful. Financial leverage can also be used to enhance an investor’s portfolio by providing additional funds to make more investments.

The degree of financial leverage is often measured by the Equity Multiplier, which is the ratio of total assets to total shareholders’ equity. A high Equity Multiplier indicates that a company is using more debt to finance its assets, while a low Equity Multiplier indicates that the company has fewer debt obligations. Other measures of financial leverage include the Debt-to-Equity Ratio, which compares total debt to total equity, and the Debt-to-Assets Ratio, which measures total liabilities compared to total assets.

Although financial leverage can potentially provide significant rewards, it also carries certain risks. One downside risk of leverage is that if the investment does not perform as expected, the investor may have difficulty paying back the debt. Furthermore, higher levels of leverage mean greater risks for investors, since their investment losses are amplified by the leverage factor. Therefore, it is important for investors to understand the risks associated with leveraging their investments and to develop strategies for mitigating those risks.

How can financial leverage be used?

Financial leverage, or the use of borrowed funds to increase the potential return of an investment, is a powerful tool used by investors. When used properly, leverage can amplify returns while also providing a degree of downside protection in the event of a market downturn. By leveraging their capital, investors are able to increase their potential returns and magnify their potential profits.

Financial leverage can be measured using several ratios, such as the Equity Multiplier, Debt-to-Equity Ratio, and Debt-to-Assets Ratio. The Equity Multiplier is the ratio of total assets to shareholders’ equity and is calculated by dividing total assets by shareholders’ equity. The Debt-to-Equity Ratio measures the degree of financial leverage by dividing total liabilities by total equity and can be used to determine how much debt is being used to finance a company’s operations. The Debt-to-Assets Ratio measures the extent to which a company uses leverage to fund its operations by dividing total liabilities by total assets.

By using leverage, investors can increase their potential returns without taking on too much risk. However, investors must be aware that leverage can also increase the downside risk in their investments. Therefore, it is important for investors to be mindful of how much leverage they are using and ensure that they are managing the risks associated with financial leverage appropriately.

What are the risks associated with financial leverage?

Financial leverage can be an effective tool when used properly, but it can also carry with it some risks that should be considered. The degree of financial leverage – or the ratio of debt to equity – is a measure of risk and can vary greatly depending on the type of transaction. Higher leverage ratios mean greater potential returns, but also greater risk.

The Equity Multiplier, also known as the Debt-to-Equity Ratio, is one way to measure financial leverage. It compares the total amount of debt in a company to its shareholders’ equity and is a key indicator of financial risk. A high Equity Multiplier indicates that a company is taking on more debt than equity, which can increase the downside risk associated with their investments.

The Debt-to-Assets Ratio is another measure of financial leverage. This ratio compares the amount of debt in a company’s capital structure to its total assets and can also help to identify potential risk. A high Debt-to-Assets Ratio indicates that a company has borrowed heavily and may be at a higher risk for defaulting on its loans.

In conclusion, financial leverage can be a powerful tool when used correctly, but investors should be aware of the risks associated with it. The degree of financial leverage, the Equity Multiplier, and the Debt-to-Assets Ratio are all measures of risk that investors should take into consideration when deciding whether or not to use financial leverage. Taking the time to understand these risks can help investors make informed decisions and maximize their potential returns while minimizing their downside risk.

How can investors mitigate the risks associated with financial leverage?

Financial leverage can be a powerful tool to increase returns, but it also carries certain risks. To protect their investment, investors must take the necessary steps to mitigate these risks.

The degree of financial leverage can be measured using various metrics, such as the equity multiplier, debt-to-equity ratio, and debt-to-assets ratio. By monitoring these metrics, investors can make sure that their leverage exposure is within their risk tolerance.

Investors should also diversify their investments to reduce their downside risk. This means investing in assets with different levels of volatility and different expected returns. This helps to reduce the overall impact of financial leverage on an investor’s portfolio.

Finally, investors should use stop-loss orders to minimize their losses in case the market moves against them. A stop-loss order sets a predetermined price at which an investor will sell an asset if its value drops below that price. This helps to ensure that losses are kept to a minimum. By taking these steps, investors can mitigate the risks associated with financial leverage while still benefiting from its potential returns.

-Divya Chaudhary

Follow us on telegram for more updates and content: https://telegram.me/tradeshala_india