Introduction

Trading in international markets involves buying and selling financial instruments such as stocks, bonds, commodities, currencies, and derivatives across global markets, typically in multiple currencies. However, trading inherently carries risks due to volatile price fluctuations, unpredictable economic events, and geopolitical uncertainties that can lead to significant financial losses.

To succeed in such dynamic markets, effective risk management is crucial. This is where Stop Loss and Take Profit come into play. These tools help traders safeguard their capital, mitigate potential losses, and secure profits. To understand their importance better, we must first explore another key concept: stop-out level.

What is a Stop-Out Level?

Contrary to what the name might suggest, a stop-out level doesn’t prevent trading. Instead, it refers to the threshold at which a broker automatically closes a trader’s positions to prevent further losses when the account balance falls below a specific margin requirement.

Traders typically trade using leverage provided by brokers, which allows them to take larger positions with a smaller margin. However, with leverage comes increased risk, it is double edge sword, it can magnify profits and losses can also be magnified. To protect traders from falling into excessive debt, brokers set a stop-out level.

Feeling overwhelmed by trading terminologies? Let’s simplify the concept of the stop-out level in trading.

Imagine you’re playing a game where you borrow money to buy assets (like stocks or currencies). These assets’ values can go up or down. If their value drops too much, the money you borrowed is at risk. To protect the broker (and yourself), there’s a limit in place called the stop-out level.

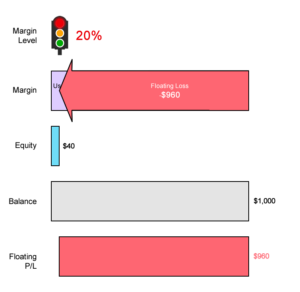

When your account balance falls below a certain percentage (set by the broker), and you don’t have enough money to cover the losses, the broker steps in. They’ll automatically sell some of your positions to prevent your account from going into a negative balance. This ensures that you don’t lose more money than you have deposited.

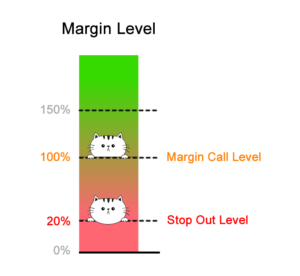

These margin levels, leverage ratios, and level percentages vary from broker to broker. One must pay extra attention to these details before registering with a particular broker.

Think of it as a safety mechanism to keep losses manageable. Always monitor your margin level to avoid reaching this critical point.

For example, if a trader opens a position requiring a $100 margin and the broker’s stop-out level is 20%, the broker will automatically close the trade when losses reach $80, leaving the trader with only $20. This ensures that losses don’t exceed the trader’s available capital.

What is Stop Loss?

A Stop Loss (SL) order is a pre-set instruction to close a trade at a specific price level to limit potential losses. Think of it as a safety net that prevents traders from suffering significant financial damage. It allows them to “live to fight another day.”

To illustrate, imagine a skydiver enjoying a freefall. Suddenly, the wind changes direction, and they find themselves heading toward a mountain. The skydiver has set a rule to pull the parachute when they are 100 feet away from the mountain. In this analogy:

• The freefall represents the trade.

• The mountain represents market risk moving against the trader.

• Pulling the parachute is the stop-loss mechanism, which saves the trader from severe losses.

• Pulling the parachute is like activating your stop-loss—it automatically pulls you out of a bad situation before you crash and burn.

Similarly, this stop-loss mechanism saves the trader from severe losses.

Just as a parachute saves you from disaster by halting a free fall, a stop-loss protects traders by exiting a losing trade before the risk becomes unmanageable. It serves as a safeguard for your account, preventing severe losses and preserving your capital.

Why is Stop Loss Important?

1. Risk Mitigation: Stop loss helps traders limit potential losses and manage risk effectively. This is especially vital in highly volatile markets such as forex, where sudden economic news or geopolitical events can cause significant price swings.

2. Emotional Discipline: Losses can trigger emotional responses, leading to impulsive trading decisions. A stop-loss order eliminates emotions from trading by automatically closing losing positions, encouraging traders to develop disciplined trading habits.

3. Long-Term Sustainability: Limiting losses ensures traders can preserve their capital for future trading opportunities, which is essential for long-term success in the market.

Types of Stop Loss Orders

The stop-loss percentage, or the amount of price movement you are willing to tolerate against your position, must be determined individually. Common types of stop-loss mechanisms include trailing stop-loss, percentage stop-loss, sell-stop, and more.

Among these, the trailing stop-loss is particularly popular and beginner-friendly. It automatically adjusts the stop price based on the security’s market price, maintaining a fixed distance behind it. This strategy helps lock in profits while allowing for potential gains.

The key benefit of a trailing stop-loss is that it moves positively with the market, keeping the trader in the profit zone. When the market reverses, the stop-loss prevents further losses by exiting the trade before entering the loss zone.

Example: David buys a security for $100 with a $20 take-profit and a $95 stop-loss. As the price moves to $113, David has an unrealized profit of $13. If the price continues to rise, the stop-loss can be adjusted to $108. This ensures that even if the price reverses, David can secure a profit of $8. While this reduces the total gain, it ensures David remains in the profit zone and avoids a loss.

What is Take Profit?

On the other side of the spectrum, Take Profit (TP) is a pre-set instruction to close a trade once it reaches a desired profit level. It helps traders secure their gains without constantly monitoring the market.

Think of it as playing a video game where you’ve accumulated significant points. Before taking unnecessary risks that could cause you to lose all your progress, you decide to save your game once you hit your target score. In trading:

• The game is your trade.

• The target score is your desired profit level.

• Saving the game is your take-profit order, which locks in profits before market conditions change.

Why is Take Profit Important?

The take-profit (TP) feature is invaluable in highly volatile markets, where security prices fluctuate rapidly, sometimes within seconds. This feature enables traders to automatically close a trade at a predetermined price, securing desired profits without the need for manual intervention. It helps avoid reduced profit margins caused by delays in manually closing trades, which can be detrimental to traders in fast-moving markets.

However, traders must carefully determine the appropriate level for their TP orders. While the feature helps lock in profits, it may sometimes close trades prematurely if the market continues moving in the trader’s favor after the target price is reached. Balancing risk and reward is key to using this feature effectively.

Key Benefits of the Take-Profit Feature:

1. Profit Protection: Take-profit orders allow traders to lock in their desired profits without worrying about subsequent price movements. Once the target price is reached, the trade is closed automatically, securing the predetermined profit.

2. Prevention of Greed: Greed can often lead traders to hold onto positions longer than necessary, hoping for even higher profits—only to suffer losses when the market reverses. TP eliminates this emotional factor by closing trades at the set profit level, ensuring disciplined trading.

3. Suitability Across Multiple Time Zones: Traders operating across different time zones or unable to monitor trades 24/7 benefit significantly from TP (and stop-loss, SL) orders. These features automate trade management, allowing traders to focus on other priorities while the system handles ongoing trades.

4. Mitigation of Market Volatility Risks: In volatile markets, prices can momentarily spike to the desired level before reversing. TP orders capture such opportunities, ensuring profits are secured during brief favorable price movements.

Trailing Take Profit

Just like trailing stop loss, trailing take profit allows traders to adjust the profit target as the market moves in their favor. This way, traders can increase their profit potential while still securing a portion of their gains if the market reverses.

Let’s revisit the example of David, who initially set a take-profit level at $120 and a stop-loss level at $108 after buying a security at $100. As the price moves up to $118, During his analysis, David believes that the price is going much higher, then David decides to trail his take-profit to $135 while also moving his stop-loss higher to $125. This strategy ensures that even if the market turns against him, he can still secure a profit of $25.

Conclusion

Stop-loss and take-profit orders are indispensable risk management tools in trading, helping traders manage risk, protect their capital, and secure gains. By automating trade exits, these tools remove emotional biases, ensuring traders can focus on strategic decision-making and long-term profitability.

While stop-loss prevents excessive losses, take-profit locks in desired profits, making them essential components of a comprehensive risk management strategy. Together, they enable traders to navigate volatile markets with greater confidence, ensuring both protection and sustainability over time.

As a Tradeshala intern, this experience has provided me with invaluable practical knowledge in trading. If you’re looking to learn trading and enhance your skills, I highly recommend applying for the internship. Click here to apply

Written By-

P. Mahesh Guptha

CFA Level 1

The Wall Street School

Capital Market Analyst Intern